Modifications to Stamp Taxes in Karnataka

Brief Overview:

Stamp taxes on various key instruments in Karnataka has been modified by the Karnataka Stamp (Amendment) Act, 2023.

Technical Details:

The Karnataka State Legislature has introduced amendments to the Karnataka Stamp Act, 1957 through the Karnataka Stamp (Amendment) Act, 2023. Modifications have been made to the stamp duty rates on various instruments, including, inter alia mortgages, sale agreements, miscellaneous agreements, power of attorney, and conveyances.

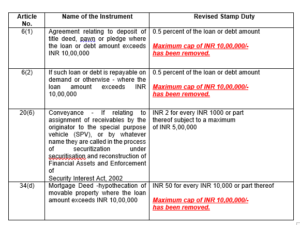

Stamp duty table highlighting certain key changes

JC Takeaways:

Abolishing the upper cap on stamp duty for documents associated with mortgage instruments and transitioning to an ad valorem basis will result in increased costs for borrowers engaged in secured lending transactions in the State of Karnataka.

For further details, please see:

http://erajyapatra.karnataka.gov.in/WriteReadData/2024/6828.pdf

For any queries / clarifications, please feel free to ping us and we will be happy to chat: