Brief Overview:

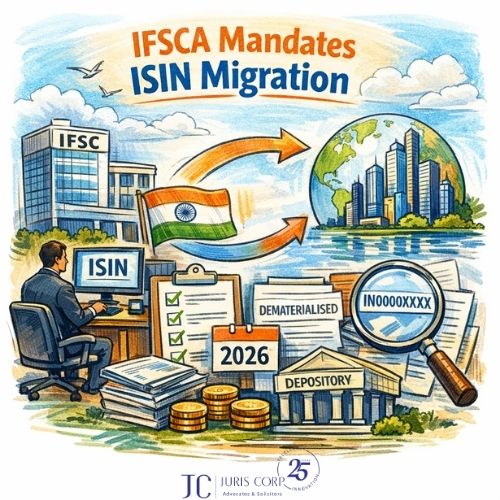

The amendment to the Foreign Portfolio Investors Regulations marks a significant move to simplify and streamline access for certain categories of foreign investors while aligning rules for IFSC-based funds.

The amendments shall come into force on 30th May 2026.

Technical Details:

Key Highlights

1) SWAGAT-FI (Single Window Automatic and Generalised Access for Trusted Foreign Investor) introduced for low-risk investors like government-related investors & public retail funds. Relaxation of registration fees i.e. now for every block of 10 years (earlier 3year cycle).

2) Mutual Funds can now be a constituent for an FPI applicant.

3) In addition to AIFs, retail schemes set up in IFSC applying for FPI registration can have resident Indians as constituents.

4) Resident Indian contribution threshold changed to:

(a) AIFs: 10% of corpus (earlier 2.5% of corpus or USD 750 thousand for Catg I & II AIFs)

(b) Retail scheme: 10% of AUM (earlier 5% of corpus or USD 1.5 million for Catg III AIFs)

Takeaways:

Yet again opening up the FPI space for a broader range of investors.

For further details, please see:

SEBI (FPI) (Second Amendment) Regulations, 2025

For any queries/clarifications, please feel free to ping us and we will be happy to chat: