Brief Overview:

UTI a Unique Transaction Identifier assigned to an OTC transaction is proposed to be introduced in addition to LEI which uniquely identifies the counterparties of such transaction.

Technical Details:

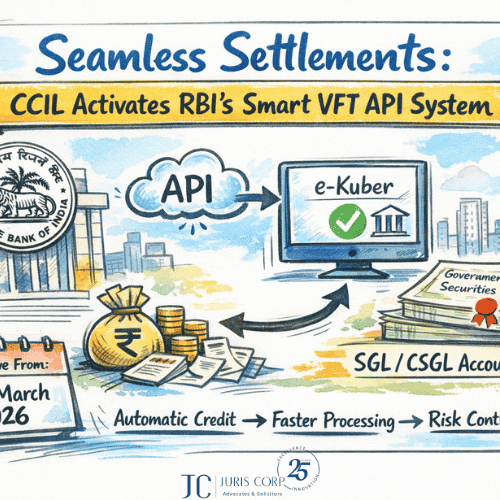

Implementation of UTI shall not alter the reporting obligations for OTC derivative contracts mandated to be reported to CCIL-TR. Market participants are required to continue reporting transactions in accordance with the existing regulatory directions. CCIL will release updated reporting formats for OTC derivative transactions, including any amendments or modifications to incorporate the UTI, along with the corresponding operating guidelines.

It is mandatory for all OTC derivative transactions undertaken by Indian entities, including Indian branches of foreign banks, to comply with the UTI framework, with the responsibility for UTI generation clearly defined under the applicable guidelines.

Novation/new contracts = new UTI generation.

Takeaways:

The UTI framework aligns Indian trade reporting with global standards, enabling enhanced reporting and giving regulators a unified view of OTC derivative transactions in India.

For further details, please see:

For any queries/clarifications, please feel free to ping us and we will be happy to chat: